Step 1: SHOULD YOU BUY A HOME IN CALIFORNIA?

Is now the right time for you to buy a home in California?

In general, YES!

Why?

There are affordable places to live.

Although California home prices have increased, there are still many affordable urban and rural communities that have a reasonable cost of living, lower median home value, and good affordability ratio.

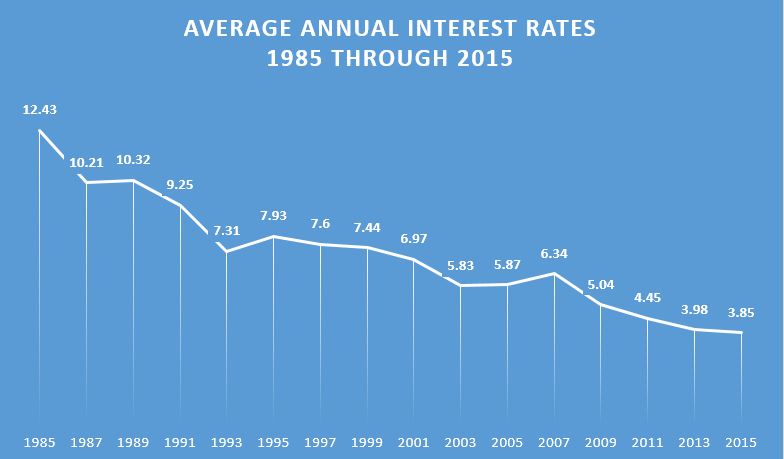

Interest rates are low on a 30-year fixed mortgage.

In fact, rates are at or near all-time lows. Therefore, you can lock in at a low payment for the life of the loan. This means that right now, owning a home and qualifying for a mortgage is easy and affordable.

Consider this: For a loan of $150,000 your payment goes up about $90 a month for every 1% increase in rate.

Chart created with data from: http://www.freddiemac.com/pmms/pmms30.htm

Because homes in California are going up in value, this will help you build equity.

According to Orange County Register, the average house is expected to increase in value by 3.3% in the next year. So, for example, if you buy a home for $150,000, you should gain a little over $6000 in equity in the next year. And it could be more.

“Homeownership plays a pivotal role in the U.S. economy and has historically been one of the primary sources of wealth accumulation for middle class families,” – Lawrence Yun, NAR Chief Economist

With that said, home values fluctuate. Although most people agree that, even when adjusting for inflation, home values increase over time.

Bottom Line: If you want to own a home in California, now is the time.

Why Buy Instead of Rent?

When you rent, you pay someone else’s mortgage. You’re helping someone else obtain the benefits of home ownership.

Home ownership has many benefits.

Consider this type of home:

1300 square foot home with 3 bedrooms and 2 bathrooms

Rent This Home:

Monthly Payment: $1,050

Rent paid after 1 year: $12,600

Rent paid after 3 years: $39,722

Rent paid after 5 years: $69,623

Total Tax Savings: $0.00

Total Equity Gained: $0.00

Buy This Home:

Purchase Price: $154,600

Monthly Payment: $1,110

Total Payments after 1 year: $13,320

Total Payments after 3 years: $40,204

Total Payments after 5 years: $67,441

Tax Deductions after 1 year: $1,675

Tax Deductions after 3 years: $4,941

Tax Deductions after 5 years: $11,095

Equity Gained after 1 year: $13,242

Equity Gained after 3 years: $31,540

Equity Gained after 5 years: $51,396

(1) assuming rental increase of 5% per year

(2) Principal, Interest, Tax, Insurance and HOA

(3) assuming property tax increase of 5% per year

(4) assuming 25% tax bracket.

(5) assuming 3% down payment* + 4% appreciation + principal paid)

* find out how to buy your home with no money out of pocket

(6) assuming 4% appreciation + principal paid

As demonstrated, buying a home in California builds wealth more times than not.

All things considered, home ownership just feels good.

Why Shouldn’t You Buy a Home in California?

The reasons behind not buying a home require a personal assessment of your situation, goals and lifestyle. Personal and financial priorities will determine what’s best for you.

Don’t Buy Before You’re Ready

Ask Yourself:

“Is it a good time to buy a house in California?”

“Am I better off buying than renting?”

“Do I understand the pros and cons of buying a house?”

“Do I understand the costs of homeownership?”

“Is my employment stable, and is my income steady?”

“Do I have a budget? What kind of house can I afford?”

Don’t Buy if You Aren’t Prepared for the Responsibility

There are many responsibilities behind home ownership such as maintenance and repairs.

Ask Yourself:

“Do I want to maintain a yard?”

“Am I prepared to repair common household problems such as holes in the drywall, broken door locks, clogged drains, and leaky faucets?”

“Can I afford larger household expenses such as replacing the carpet, repairing the roof, and replacing the AC unit?”

Don’t Buy a Home if You Move A Lot

Homeownership can tie you down. Don’t buy if you aren’t ready to settle down.

Here is more information about renting or buying a house in California

Professionals are Available … Ask A Lot of Questions

Buying a home is a large purchase. If you’ve never bought a home before, you probably have a lot of questions.

“Smart people ask questions about buying a home in California because it saves them money.”

Don’t be afraid to ask questions. The home buying process is full of pitfalls. We’re here to help.

Legal Disclaimer

This home buyer series is intended to provide general information regarding the process of how to buy a house in California. It is not intended to provide buyers with legal, accounting or financial advice. You are advised to seek the services of a skilled professional this those fields.

Additionally, this home buyer series does not set forth all qualification criteria for any of the loans described herein; all interested persons must successfully meet qualification criteria and complete the application process to obtain such loans.