Step 6: GET PRE-APPROVED TO BUY A HOUSE IN CALIFORNIA

Before you buy a house in California, you should take the time to get pre-approved.

What is Pre-Approval?

A pre-approval is a written commitment from a lender that says you qualify for a particular loan type and loan amount, which is based on information you provide.

To obtain a pre-approval letter, contact a mortgage lender. An initial discussion should only last between 15 – 30 minutes, and if you provide all requested information, it normally takes 24 to 48 hours.

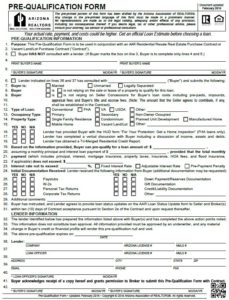

In California, it is standard practice to issue a pre-approval letter by the California Association of Realtors (AAR) called the “Pre-Qualification Form”.

Why Get Pre-Approved?

There are quite a few advantages of pre-approval:

- You will know how much you can borrow: This makes your home search more efficient. You wont waste time on homes you cant afford.

- A pre-approval letter is essential in a competitive real estate market: If you want to make an offer on a house, having an accompanying pre-approval letter provides more incentive for the seller to consider your offer.

- Better position to negotiate: The seller will know you are a serious buyer if you’ve done your homework.

- Save time on closing: Once your offer is accepted, you will be able to close faster because you have the required paperwork.

First Step – Pre-Qualification

Pre-qualification is the first step in the mortgage process. You can provide general information about your financial situation in person, over the phone, by email, or online.

Pre-qualification discussion usually involves the following topics:

Income – The lender will want to know your gross monthly income, or of all people that will be on the loan. This is to determine if your income is stable and durable. If a portion of your income is variable (ex. overtime or commissions), the lender may have to determine an average.

Debts – The lender will calculate your debt-to-income ratios (debts divided by total gross income). This number determines your maximum qualification amount. You can choose to have the lender pull and review a copy of your credit report for more precise accuracy.

Assets – The lender will ask questions about your assets to see if you have enough money for a down payment, closing costs and reserves (which is money left over after you buy the home). The total amount need depends on what loan program you choose.

Where can I get money for my down payment?

Down payments tend to be the biggest obstacles in home ownership. However, there are a number of ways to come up with the cash.

Savings – Money that has been put aside and saved.

Gift – In the mortgage business, a gift is money from a friend, relative or employer to help with a down payment. For it to be a gift, there can be no obligation to pay back the money; otherwise, it is debt.

Grants and Down Payment Assistance Programs – There are a variety of home buyer assistance programs available in California to help you with your down payment.

Credit – Lenders will ask questions about your credit to see if there are red flags that might disqualify you from a mortgage (ex/ recent bankruptcy). As stated above, you can choose to have the lender pull and review a copy of your credit report. Typically, the higher the credit score, the better the interest rate you receive.

With the information provided, a lender will advise you as to what loan program options are available, and provide an estimate of what your maximum purchase price, loan amount and monthly payment should be. Pre-qualification is usually free with no commitment from you or the lender. If your desired monthly payment is less than your maximum prequalified amount, you and / or the lender can calculate overall expenses.

At this point, the lender should be able to complete lines 1 – 23 on the AAR Pre-Qualification form.

Second Step – Obtain a Signed Pre-Approval Letter

It should be noted that pre-qualification is not the same as a pre-approval, although sometimes the terms are used interchangeably. Pre-qualification is a quick process that tells the buyer how much they potentially qualify for, based on preliminary information provided.

Pre-approval is when the lender gathers enough information for you to complete a full loan application. They request supporting documentation to be reviewed and analyzed. If the lender hasn’t already pulled your credit report, they will do so now. After a review of those documents, a pre-approval letter will be issued.

The documents are as follows:

- Income verification:

- Pay stubs with year-to-date amounts for the last 30 days.

- W-2 forms for all employment in the last 2 years.

- Complete copies of previous 2 years personal tax returns including all schedules.

- Asset verification:

- Copy of the past 2 bank months statements (all pages).

Depending on the loan or down payment assistance program you’re using, the lender may need to check to see if the income from all borrowers is above the maximum allowed, or if you have enough residual income.

At this point the lender should be able to complete, sign and provide you with the entire AAR Pre-Qualification form.

Legal Disclaimer

This home buyer series is intended to provide general information regarding the process of how to buy a house in California. It is not intended to provide buyers with legal, accounting or financial advice. You are advised to seek the services of a skilled professional this those fields.

Additionally, this home buyer series does not set forth all qualification criteria for any of the loans described herein; all interested persons must successfully meet qualification criteria and complete the application process to obtain such loans.